Key Takeaways from the 2020-21 Federal Budget

On 6 October, Treasurer Josh Frydenberg delivered the most significant Federal Budget in decades, with a focus on boosting the economy, asset write-offs, business concessions and cuts to personal tax rates.

With an anticipated Budget deficit in 2020-21 of $214 billion and further deficits anticipated over the medium term, this years’ budget encourages spending while also delivering many tax-related measures for businesses to slowly move back to surplus.

While the road to recovery will be long for many businesses and individuals, the initiatives introduced in this Budget will assist in making that journey easier for many.

Changes to personal income tax cuts

Building on the tax bracket cuts of the 2019-20 budget, further tax cuts originally proposed to take effect from 1 July 2022 will now be brought forward to 1 July 2020.

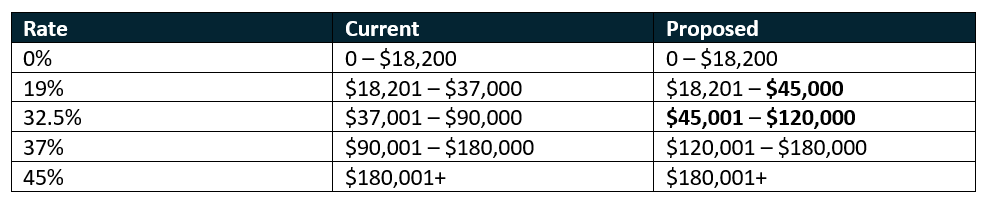

These changes mean that the upper threshold of the 19% personal income tax bracket will be increased from $37,000 to $45,000 and the 32.5% personal income tax bracket from $90,000 to $120,000.

The table below outlines the changes to the tax bracket cuts.

JobMaker Hiring Credit

As part of the government’s efforts to stimulate the economy with employment growth, a new JobMaker Hiring Credits program for employees aged 16-35 years has been announced. The program will commit $4 billion to employers over the next three years who hire young people, effectively reducing their JobSeeker, Youth Allowance or Parenting Payment payments.

From 7 October 2020, eligible employers can claim up to $200 per week credit for employing young Australians. This payment can be claimed for a maximum of 12 months per employee and capped at $10,400 for each additional new position created.

Uncapped immediate write-off for depreciable assets

Currently, businesses with aggregated annual turnover of less than $500 million are entitled to an immediate tax reduction for the cost of eligible depreciating assets. New temporary measures will allow businesses with aggregated annual turnover of less than $5 billion to claim an immediate deduction for the full cost of eligible capital assets acquired from 7:30pm AEDT on 6 October 2020.

Small businesses with aggregated turnover of less than $10 million can now deduct the balance of their simplified depreciation pool at the end of the income year under the new measure.

Temporary ‘loss carry-back’ for eligible companies

Eligible companies with turnover of less than $5 billion can carry-back tax losses made from the 2020, 2021 or 2022 income years to offset tax paid on profits made in or after the 2019 income year. This will allow such companies to generate a refundable tax offset in the year in which the loss is made.

Reducing the compliance burden of FBT record keeping

The Government is proposing to reduce the current fringe benefits tax (FBT) return record-keeping obligations by allowing employers to use existing corporate records. Currently, record-keeping requirements of employers can be time consuming. This new measure will reduce record-keeping obligations, instead relying on existing corporate records.

Supporting the mental health of Australians in small business – COVID-19 response package

The Government will provide $7 million in 2020-21 to support the mental health and financial wellbeing of small business owners impacted by COVID-19, including:

$4.3 million to provide free, accessible and tailored support for small business owners by expanding Beyond Blue’s NewAccess program in partnership with the Australian Small Business and Family Enterprise Ombudsman; and

$2.2 million to expand a free accredited professional development program that builds the mental health literacy of trusted business advisers so that they can better support small business owners in times of distress, delivered through Deakin University.

Insolvency reforms to support small business

Changes to the insolvency framework will provide much-needed breathing space to distressed small businesses. The changes include a streamlined new debt restructuring process, a faster and more flexible liquidation process for small businesses and support for the insolvency sector.

Although unfortunate, this option may be the reality for many small businesses in the face of COVID-19. We recommend business owners consult with the team at Carter Connell for expert advice before making any decisions.

For more information about any of the Federal Government’s changes or Budget announcements, contact Carter Connell today for an obligation free consultation.

Carter Connell is a highly experienced business advisory, taxation and accounting firm. We understand the devastating impact that COVID-19 has had on many Australian businesses and we have the tools and expertise to help you.

Complete the contact form here to get in touch.

Disclaimer: this information is of a general nature and should not be viewed as representing financial advice. Users of this information are encouraged to seek further advice if they are unclear as to the meaning of anything contained in this article. Carter Connell accepts no responsibility for any loss suffered as a result of any party using or relying on this article.